Q: Everyone I talk to seems to have already gotten their stimulus money, but I’m still waiting for mine to arrive. Where is my stimulus check?

A: More than half of eligible Americans have already received their Economic Impact Payment, but tens of millions more are still waiting. We’ll let you in on when you can expect yours, how to help it come quicker and why you may not even be receiving a stimulus payment.

The schedule for issuing payments

The IRS is trying to get the stimulus payments out to Americans as quickly as possible, but with approximately 150 million checks that need to be issued, it will take some time.

First, the IRS is working on getting the funds to Americans via direct deposit. Most of the payments being issued to people whose account details are known by the IRS have already been distributed and the rest is scheduled to be deposited as the information is obtained.

Next, the IRS will send payments for individuals currently receiving federal benefits, such as Social Security checks, retirement or disability benefits, Railroad Retirement benefits, Supplemental Security Income (SSI) or Veterans Affairs (VA) benefits. The stimulus payments will be issued the same way these individuals receive their regular federal benefits, whether by direct deposit, Direct Express or paper check. The Treasury has promised that all Social Security and Railroad Retirement beneficiaries will receive their benefits by early May. SSI and VA beneficiaries should get their payments by mid-May.

On April 24, the IRS began issuing paper checks to Americans who have not provided their banking details. Low-income Americans are prioritized, and individuals earning an adjusted gross income (AGI) of $10,000 or less should have already received their checks. The IRS will then send out approximately 5 million paper checks each week, scheduling the mailings according to incomes in increasing $10,000 increments. For example, checks for individuals with an AGI that falls between $20,000 and $30,000 were mailed out on May 1. On May 8, the checks for people with incomes between $30,000 and $40,000 will be mailed out. This schedule will continue through Sept. 4.

How can I make my stimulus money get here quicker?

As mentioned, funds being distributed via direct deposit are issued first. The IRS will use your most recently filed taxes to determine where to send your stimulus money and the amount you are eligible to receive. If your most recently filed returns have not yet been processed, or you’ve received your refund by paper check, the government does not have your checking account information, so your payment may be delayed.

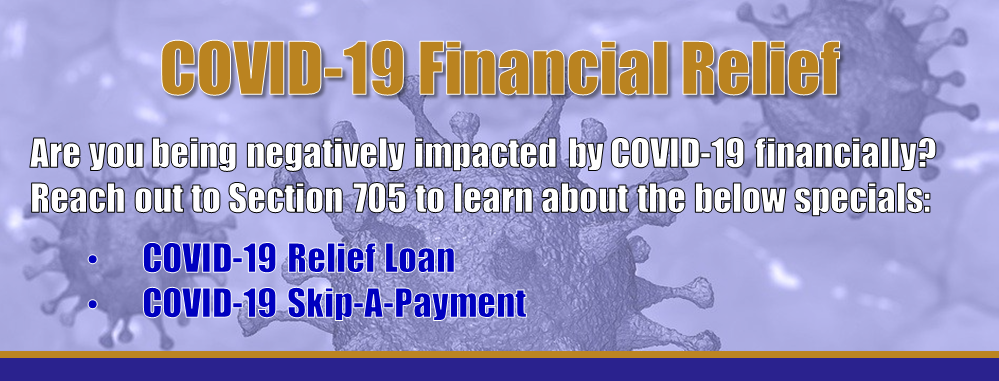

You can update this information on the recently updated track your payment portal on the IRS website. You will need your Social Security number, the gross income of your most recent tax returns, your Section 705’s routing number ([XXXXXXXXX]) and your checking account information. Once you’ve shared your account information, your stimulus payment should be scheduled for deposit within the week.

If the IRS already has your account information and you still have not received the stimulus money, or you would prefer to receive your payment by paper check, you can track your payment on the same link. The site is updated once a day.

What if my information has changed since I filed my last tax return?

If the checking account used for your most recently filed taxes has since been closed, the payment will bounce back to the IRS, which will then send a paper check to the home address it has on file from your tax returns.

To update a checking account, use the IRS payment portal to enter your current information.

If you’ve moved since filing taxes, you can choose to share your checking account information with the IRS, or to use another method which may include informing the U.S. Postal Service of a change of address.

What if I don’t file taxes?

If you are not required to file taxes and you are eligible for an Economic Impact Payment, you can still receive your check. Just enter your information here.

Why you may not qualify for a check

The CARES Act does not promise payments for every American. Dependents older than 16, individuals who do not have a Social Security number and those with an AGI above $99,000, will not be getting a stimulus payment. The threshold is higher for individuals filing as a head of household, at $136,500, and up to $198,000 for joint filers.

Watch out for stimulus scams

While the IRS urges people to update their information on the payment portal, it’s important to note that they are not reaching out to individuals. If you receive a phone call, social media post, email or text message asking for your banking information, it is likely a scam. There is also no application fee or processing fee for the Economic Impact Payments. If you’re asked to pay one, it’s also a scam.